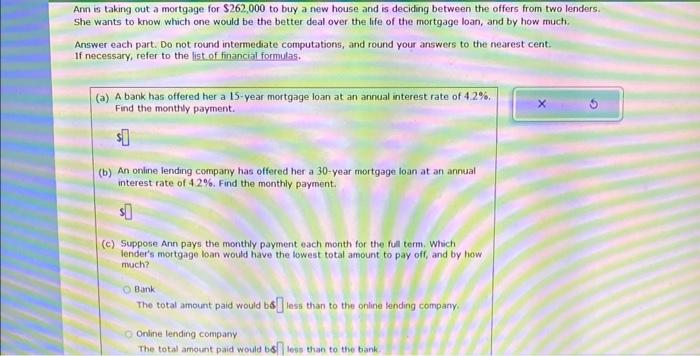

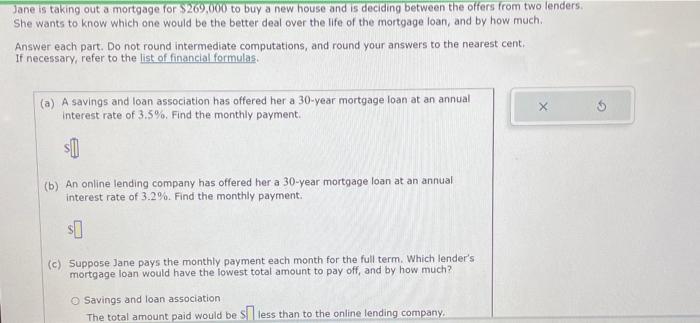

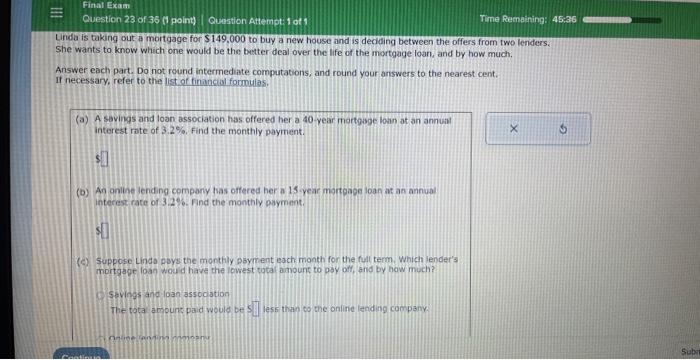

Depending on the conditions of the user, even the same apartment subordinated mortgage will differ Therefore, please make a fund plan after checking the conditions of actual use through the Financial Plus free inquiry comparison service

Depending on the conditions of the user, even the same apartment subordinated mortgage will differ Therefore, please make a fund plan after checking the conditions of actual use through the Financial Plus free inquiry comparison service

Depending on the conditions of the user, even the same apartment subordinated mortgage will differ Therefore, please make a fund plan after checking the conditions of actual use through the Financial Plus free inquiry comparison service

Depending on the conditions of the user, even the same apartment subordinated mortgage will differ Therefore, please make a fund plan after checking the conditions of actual use through the Financial Plus free inquiry comparison service

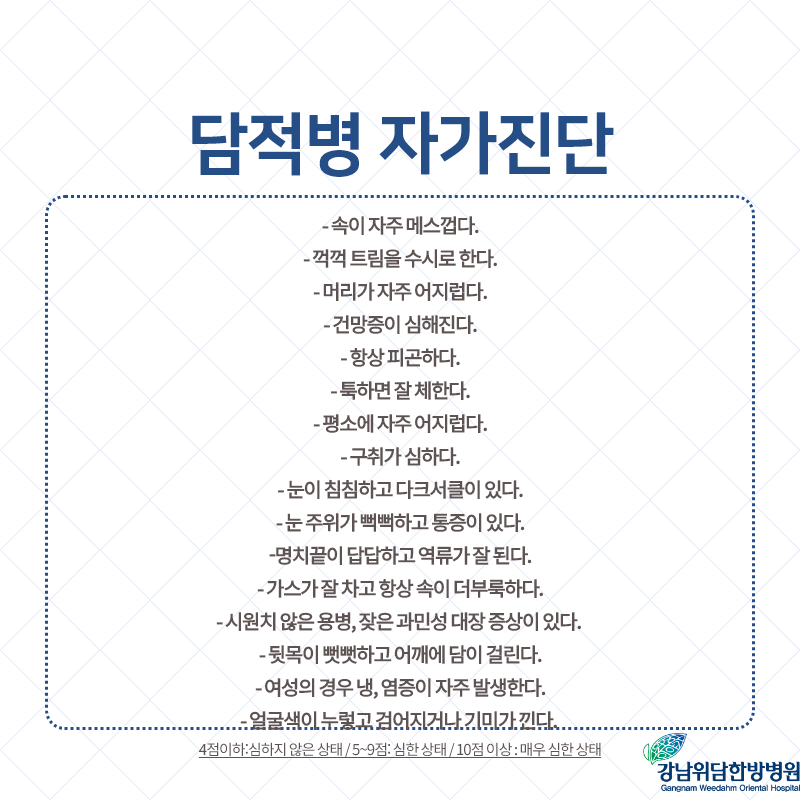

Confirmation of conditions for raising funds for information business of subordinated products \

Even when there is a loan already in use, additional collateral products that are used without repayment were a chronic problem in raising funds, regardless of DSR and LTV regulations.. Not only can it be prepared, but it is flexible compared to credit, so many unemployed people can use additional funds such as private businesses, corporate businesses, new businesses, and additional operating funds

Even when there is a loan already in use, additional collateral products that are used without repayment were a chronic problem in raising funds, regardless of DSR and LTV regulations.. Not only can it be prepared, but it is flexible compared to credit, so many unemployed people can use additional funds such as private businesses, corporate businesses, new businesses, and additional operating funds

It’s the same condition, but why is it difficult? It’s difficult to rank new businesses, corporate businesses, apartment mortgage loans

In fact, there are preferential conditions for businessesIt’s okay to look at it, but it’s true that everything is not the same, so it’s more difficult than the general self-employed individual businesses who raise funds for new businesses, corporate businesses, collateral use, and businesses…The existence of preferential conditions is more focused on income screening, but it is practically difficult to determine income for three to six months for general businesses, but it is often a condition for unemployed people, not for rejection or business conditions

In fact, there are preferential conditions for businessesIt’s okay to look at it, but it’s true that everything is not the same, so it’s more difficult than the general self-employed individual businesses who raise funds for new businesses, corporate businesses, collateral use, and businesses…The existence of preferential conditions is more focused on income screening, but it is practically difficult to determine income for three to six months for general businesses, but it is often a condition for unemployed people, not for rejection or business conditions

In order to raise funds for business operation as a subordinate to corporate businesses’ apartment mortgage loans, the three-year income as mentioned above is also different for each financial company, for example, to explain this part

First-year loss corporation Second-year loss corporation Third-year profit conversion

First-year loss corporation Second-year loss corporation Third-year profit conversion

:max_bytes(150000):strip_icc()/mortgage-69f02f04cdae4863806bd0455255106e.png)

First-year profit Second-year profit Third-year loss corporation

:max_bytes(150000):strip_icc()/TermDefinitions_commericalloan-1d7b55117f6646b9bb3987228def748a.jpg)

In the case of a financial company, it is necessary to set a limit and review by adding more recent profits to a financial company for three years to determine all possible conditions to prevent such problems from occurringIn the case of a financial company, it is necessary to set a limit and review by adding more recent profits to a financial company for three years to determine all possible conditions to prevent such problems from occurringIn order to raise funds for business operation in the lower order of apartment mortgage loans for new businesses, if the reported income is still small due to the lack of conditions of the screening process for the income part as mentioned above… However, the examination is not conducted only by reporting income, but it is necessary to check other things. As it is used for bankbook income other than some reported income, not only the additional limit interest rate but also the details of the examination should be checkedFinancial Plus, a site that provides information that can be used by grasping such information and checking not only the interest rate limit but also the contents of the screening criteriaPlease use it after diagnosing each of the subordinated conditions of apartment mortgage loans for new corporations that can be subject to unemployed conditionsDon’t forget that not all financial companies’ screening contents are the same, and it’s difficult I will conclude my article today by emphasizing the importance of comparing interest rates that meet the requirements of new corporate operators that are inconvenientThank you.Financial Plus, a site that provides information that can be used by grasping such information and checking not only the interest rate limit but also the contents of the screening criteriaPlease use it after diagnosing each of the subordinated conditions of apartment mortgage loans for new corporations that can be subject to unemployed conditionsDon’t forget that not all financial companies’ screening contents are the same, and it’s difficult I will conclude my article today by emphasizing the importance of comparing interest rates that meet the requirements of new corporate operators that are inconvenientThank you.Previous imageNext imagePrevious imageNext imagePrevious imageNext image